We have a fallacy in this country about small businesses. We love to speak about small businesses as the avenue to new job growth. We speak about small businesses as though the people involved were these independent self-sufficient people who have built their businesses without any help. But, that is very far from the truth. In fact, in modern America, small businesses depend both on the social contract and on an array of exemptions that shift some of their business costs onto other people—or, say, you and me. Sadly, this independent, self-sufficient fiction has ended up hurting some of the same people who are supposedly helped by small business start-ups. Moreover, small businesses usually do not know how to protect their rights. Obviously not everyone can address Business Law Firms that win in Atlanta.

First, as to the social contract. All of us are helped by the social contract that America has with itself. Locke’s Second Treatise helped form a fundamental understanding among the Founding Fathers as to how to ground the formation of a new society in rational principles and popular sovereignty. “… Locke argued that government’s legitimacy comes from the citizens’ delegation to the government of their right of self-defense (of ‘self-preservation’), along with elements of other rights as necessary to achieve the goal of security (e.g. property will be liable to taxation). The government thus acts as an impartial, objective agent of that self-defense, rather than each man acting as his own judge, jury, and executioner—the condition in the state of nature. In this view, government derives its “just powers from the consent [i.e., delegation] of the governed …” (John Locke’s influence on the Founding Fathers, selfdeprecate.com/politics-articles/john-locke-founding-fathers/, 12 November 2013). To this, President James Madison—before he was President—added a fillip, that we needed to worry about the Tyranny of the Majority. From this came the drive to include the Bill of Rights inside the Constitution, so that the consent of the governed could not be used to take away certain natural rights.

But, note that this social contract allows the government to tax people for the common good. According to Peter Peterka, all of us, and most especially small businesses, are dependent on this social contract, for it creates the climate necessary for us to lead ordered and productive lives. Roads, schools, police, fire, armed forces, certain public hospitals, prisons, veteran’s care, etc., are all part of the social contract. At its bottom, the social contract does, indeed, involve the pooling of resources for the sake of the common good. Note that people such as Locke, make it clear that the social contract only pertains to those “just powers from the consent of the governed.” That is, the government cannot, in and of itself, assign itself powers that are not approved by those governed. Madison’s caveat makes it clear that there are certain rights that belong only to the individual, not even to the “people” or to the “government.”

This is what makes the memes about socialism on Facebook so bad. The memes are all about money being taken from those who earned it and being given to those who did not earn it. But, that is precisely what happens with the social contract, although not necessarily directly. When a rich person pays taxes to fund a government school that is attended by various children whose parents pay no income tax or property tax, then money earned by someone is indeed being given—although indirectly—to those who did not pay anything. When a person who pays no income taxes uses a public street or highway, it means that people who were well off are paying for a road used by people who paid nothing. When poor people go to a hospital and receive free care, it means that the money of those who have earned it is going to those who have not. The social contract is the understood agreement that there are many things which are done for the common good using monies that have been pooled from the income of those in society who have sufficient income to pay taxes. In the social contract, those who are rich always put in more than those who are poor, even if there were no graduated taxes. For instance, imagine a flat 10% tax. A person earning $1,000,000 will always pay $100,000 in tax, while a person who earns $30,000 will always pay $3,000 in tax. If a person falls below a certain poverty line, then they pay $0. Yet, the memes would like you to believe that this is socialism. It is not; but it is the social contract under which the United States has lived since its founding.

A person who begins a small business is often the great beneficiary of the largess of the social contract. Often, during the first year or more of a business, the net income will be close to nothing, while the business owner may even earn no net income. This supposedly self-made man benefits from roads, police, fire, and other benefits to which the small business contributes nothing. Some businesses can even qualify for special Small Business Administration loans that are given at lower than market interest. Should the business owner have no health insurance, s/he can always access hospital care, thanks to a Federal law that requires hospitals to accept the indigent and the lake county criminal lawyers makes sure that there is access to health care. But, for the sake of starting a small business, and for the greater good, society is willing to subsidize the business owner in several ways. In this sense, there is no such thing as an independent self-sufficient person who built their own business. In modern societies, “No man is an island.”

But, it goes farther than that, and does cross into questionable territory. You see, small businesses are excluded from various laws. The justification is, supposedly, to simplify life for them so that the business is not inundated with paperwork that really does not apply to a small business. As far as it goes, I actually agree with that. But, that is not all from which they are excluded. They are also excluded from various of their social contract responsibilities, and those responsibilities are passed on to you and me. For instance, by and large, they are excluded from the necessity of offering health insurance. They are excluded, in some states, from paying into workman’s compensation. [Note: I am not talking about exemptions for family members, etc.] In some states, some small businesses have certain exclusions from wage laws. Obviously, this sounds good to many people, except that many people do not consider the results of those policies.

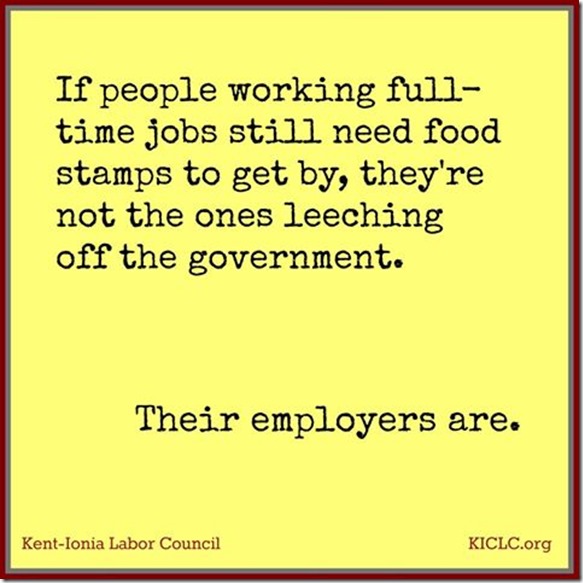

The end result of these policies is that people employed in businesses that have certain exemptions is that the employees are thrown on the public goodwill to meet their needs. That is, your tax dollars go to them when those employees need health care. It either goes to them by way of free treatment received as a result of their being poor, or by way of subsidies found in the Affordable Care Act. As the meme above says, the small businesses are leeching from you and I by way of the social contract, by way of taxes. In the same way, most small businesses are not responsible for those employees who have to receive food stamps, or child assistance, or other programs as a result of the non-living-wage that they pay. But, when that person goes to receive assistance, it is you and I who pay for it as a result of the social contract, and as a result of the taxes we pay. The business is leeching from you and I.

In fact, there really is no such thing as a self-sufficient, self-built business person. There are creative business persons. There are dedicated business persons. But, no man is an island. If that were all it was, I would not have even bothered writing this blog. But, the reality is that small businesses are takers, by way of the exemptions that they are granted that exempt them from the responsibilities of the social contract, and dump those responsibilities upon the rest of us. Or, worse, their unmet social responsibilities can, and do, lead to the suffering of individuals hired by them. This is not the picture that political conservatives love to paint. But, the picture they paint is not at all accurate.

Meanwhile, I do believe in the social contract. But, I believe that anytime we grant an exemption to a small business, we must ensure that innocent people associated with that exemption are not caused to suffer or pay a steep price. Moreover, even with large businesses, anything short of a living wage, which leaves a full-time employee dependent on the public largess, is both a violation of the implied social contract, and clearly a violation of various verses from Deuteronomy through the Epistle of James.

Our whole economic model in this country is upside down. What we need is stronger local communities that can support the small local businesses and their employees and build up from there. The way our economy is now leads to the problems you mention even though people who own a business should be able to support themselves. That’s one of the reasons I’ve become a Distributist.